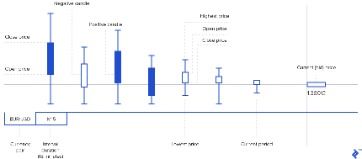

After a decline, the long upper shadow indicates buying pressure during the session. However, the bulls were not able to sustain this buying pressure and prices closed well off of their highs to create the long upper shadow. Bullish candlesticks denote an increase in price over the specified time period. When the price begins at a given level and closes at a higher level, it makes a bullish candlestick.

Look at the https://topforexnews.org/ line to see the highest price for the market. A bullish harami cross occurs in a downtrend, where a down candle is followed by a doji. A short upper shadow on an up day dictates that the close was near the high.

Hanging man, offer clues as to changing momentum and potentially where the market prices maytrend. In the next section, we’ll take a closer look at how to identify the Doji pattern on price charts. A place to discuss forex strategy, ideas, analysis, and concepts. Hopefully somewhat more advanced than the content on other forex subs, but questions are always welcome. I won’t be policing your language as most mods do; you’re adults and I hate telling people what to do…but try to not be too much of a dick.

Bearish/Bullish Harami

Long-legged Doji – It shows a state of market trend uncertainty. Gravestone Doji – The huge top wick indicates that a higher price was rejected in favor of a lower price, indicating negative emotion. Consult Benzinga’s guide to the market’s top brokers to get started today. To learn more about Ezekiel’s method of trading backed by mathematical probability, you can check out his one core program. “Just starting to learn more about trading, this is good stuff.”

Consider making Candlestick patterns an essential component of your trading system. As with all trading tools, attain firsthand knowledge and experience by tracking and following them on a regular basis so you can spot them quickly. Candlesticks are building blocks for technical analysis and strategy development. High is the highest trade price for the candlestick period and is also displayed as a wick, which is a vertical line. These patterns are common and reliable examples of bullish two-day trend continuation patterns in an uptrend.

It typically denotes the conclusion of an uptrend and is incredibly significant when the third candlestick wipes out the gains of the first. The highest price exchanged throughout the time is shown by the upper wick or top shadow. When there is no such upper wick or shadow, this indicates that the price at which the asset opened or closed is the highest traded price. The highest part of the wick on top of the real body marks the high price for that period. If there is no upper wick, then the top of the real body was also the highest price during that period. A doji is a trading session where a security’s open and close prices are virtually equal.

- The top of the upper wick/shadow indicates the highest price traded during the period.

- A bullish harami cross occurs in a downtrend, where a down candle is followed by a doji.

- An Inverted Hammer followed by a gap up or long white candlestick with heavy volume could act as bullish confirmation.

- If the price starts to trend upwards the candle will turn green/blue .

A combination of these displays the sentiment of the market towards the said stock. These details are important to know to understand how to read a candle chart. Most candles are bearish when the close is lower than the open. The red candlestick in the illustration below would be considered a bearish candle. The black wicks, or as they are sometimes referred to as shadows or tails, represent the high and low of the period. Most charting platforms will have different colors for bullish candles and bearish candles.

Crypto Adoption in 2022, by the Number of BTC & ETH Addresses The number of Bitcoin and Ethereum addresses with at least $1,000 grew by over 27%, even as prices fell in 2022. The genuine body of an inverted hammer candle is tiny, with a prolonged top wick and little or no bottom wick. It emerges at the bottom of a downtrend and typically indicates the possibility of a bullish reversal. The lowest price exchanged throughout the time is shown by the lower wick or low shadow. When there is no such lower wick or shadow, this indicates that the price at which the asset opened or closed is the lowest traded price. Munehisa Homma, a wealthy Japanese merchant, devised a technical analytical approach to examine the price of rice contracts in the 18th century.

Bearish Patterns

Our Stock Rover review reveals an excellent stock screening, research, and portfolio tool for long-term US value, income, and growth investors. Easy to use yet incredibly powerful, Stock Rover is the best stock screener available for US investors. For an in-depth guide to Japanese Candlestick charts, please look at our Pro Stock Market Training.

If the price begins to rise, the candle will become green and the candle will turn red if the price falls. The body is the major component of a candlestick, and it’s easy to spot because it’s usually large and colored. The set number of trades that must be carried out before a new candle starts to form is collectively known as a tick.

Because the bullish and bearish pressures in the market have reached equilibrium. Since these forces on the price are roughly equal, it is very likely that the previous trend will end. This situation could bring about a market reversal, which is a price move contrary to the preceding trend. “This was the most helpful article I’ve read to understand the actual candlesticks.” To identify possible changes in trends by spotting certain candlestick shapes, it is always best to look at a candlestick chart for the last 1-4 weeks of activity. As Japanese rice traders discovered centuries ago, investors’ emotions surrounding the trading of an asset have a major impact on that asset’s movement.

The https://forex-trend.net/ candlestick can also be used in breakout trading strategies. Traders can look for a Doji pattern that forms at the top or bottom of a price channel, indicating a potential breakout in either direction. For example, if a Doji pattern forms at the top of a price channel, traders might take this as a sign that the price is likely to break out to the downside. Alternatively, if a Doji pattern forms at the bottom of a price channel, traders might take this as a sign that the price is likely to break out to the upside.

With bulls having established some control, the price could head higher. A bearish engulfing pattern develops in an uptrend when sellers outnumber buyers. This action is reflected by a long red real body engulfing a small green real body. The pattern indicates that sellers are back in control and that the price could continue to decline. The very concept of candlestick charts used in forex trading comes from Japanese rice farmers in the 18th century.

The longer the upper Candlestick wick, the higher the stock price was, and the more the price was beaten down for the day. They should be preceded by at least three consecutive lower low candles. Hammers reflect a capitulation selling climax as the last hold-outs decided to exit their shares in a panic.

Use Appropriate Risk Management

During https://en.forexbrokerslist.site/ periods, the morning star pattern appears and typically suggests an upside reversal. This pattern begins with a bearish candle and then moves down to a little bearish or bullish candle. The bearish engulfing candlestick is made up of a bullish candle that is followed by a bearish candle that engulfs the first. This pattern typically suggests that a bearish move is on the way and occurs during a bullish trend.

Candlesticks help traders to gauge the emotions surrounding a stock, or other assets, helping them make better predictions about where that stock might be headed. This is followed by three small real bodies that make upward progress but stay within the range of the first big down day. The pattern completes when the fifth day makes another large downward move. It shows that sellers are back in control and that the price could head lower. For example, a down candle is often shaded red instead of black, and up candles are often shaded green instead of white. A small real body indicates a period in which the bulls and bears are in a “tug of war” and warns the market’s trend may be losing momentum.

Candlesticks give an excellent view of the Open, High, Low, and Close prices. There is a full reference of 1 bar to 4 bar patterns, which helps us make judgments on the future direction of price. An easy-to-learn system for understanding candlesticks is available in the Liberated Stock Trader PRO Training Course, including a video to help you master these charts. The third type of candlestick is a neutral candle, or also referred to as a “Doji.” A neutral or Doji candlestick can be defined by the open and close near the same price. When beginners first look at a neutral or Doji candle, they/ beginner trader usually miss the power of this type of candle. The neutral or Doji candle can signal that a possible reversal is coming.

The fifth and last day of the pattern is another long white day. The bullish harami is the opposite of the upside down bearish harami. A downtrend is in play, and a small real body occurs inside the large real body of the previous day. If it is followed by another up day, more upside could be forthcoming. Trading is often dictated by emotion, which can be read in candlestick charts.

quiz: Japanese candlestick charts

Remember, the price pattern only forms once the second candle closes. The close price is the last price traded during the period of the candle formation. If the close price is below the open price the candle will turn red as a default in most charting packages. If the close price is above the open price the candle will be green/blue .

Candlestick charts are more visual, due to the color coding of the price bars and thicker real bodies, which are better at highlighting the difference between the open and the close. As such, while the bar chart makes it look attractive to buy, the candlestick chart proves there is indeed a reason for caution about going long. Thus, by using the candlestick chart, a swing trader, day trader or even if you do active investing would likely not buy in the circled area.

Our Trade Ideas review uncovers an excellent stock scanner, an AI-powered trading signal platform with 30 channels of trading ideas and auto-trading. Three automated Holly AI systems pinpoint trading signals for day traders. Trade Ideas promises and delivers the nirvana of market-beating returns. If you can understand the story being told, you do not need to memorize each pattern’s name and the textbook meaning. Combining the action of multiple days will allow you to understand the market participants’ current psychology, giving you an insight into tomorrow’s price action.

What Common Candlestick Patterns Mean

The Hollow Candlestick represents the rising of the sun, white and full of light. Like the sun, it rises, and so does the stock price for the day. When doing my analysis when you get used to how they work; they provide an unparalleled inside into the short-term market dynamics of a given stock.